Our services:

- Fire and fire protection

- Burglary and vandalism

- Water damage due to tap water

- Natural events such as storms, hail, lightning and floods

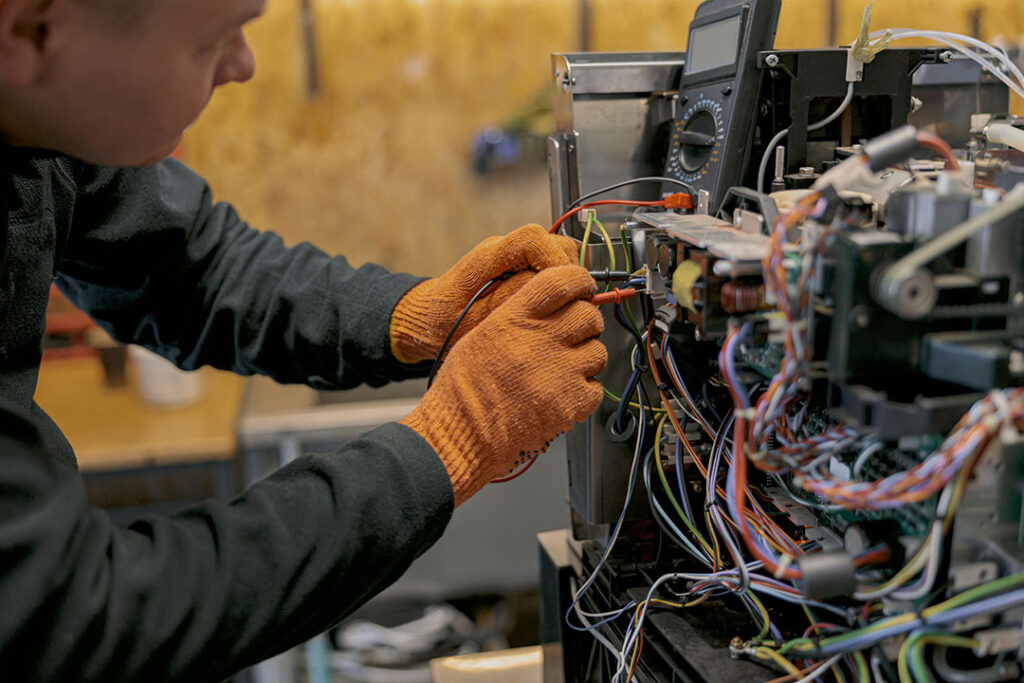

- Damage caused by technical equipment such as machines or electronics

- Business interruptions due to damage

EC Coverage (Extended Coverage)

As the name implies, EC coverage or extended coverage is an extension of the coverage of another property insurance policy. EC coverage thus offers more extensive protection than conventional business insurance.

If a traditional coverage covers the basic risks , the Extended Coverage insurance also includes rare and unforeseen events.

The result is more comprehensive coverage for the company in the event of a loss.

With EC coverage, for example, damage caused by natural events such as storms or floods is covered, but also damage caused by burglary, vandalism or technical defects.

Typical examples of damage

Typical examples of losses for extended coverage insurance include damage caused by natural disasters such as storms, floods or earthquakes. But burglaries, thefts and vandalism can also be covered by the insurance. Also covered are damages caused by fire, water damage or technical defects in machinery and electronics. In addition, the insurance also covers business interruptions caused by damage. Thus, the company can continue to run even in difficult times and the damage is covered by the insurance.

EC coverage is particularly suitable for companies and industries that are exposed to especially high risks. This includes, for example, companies in the construction industry that are confronted with large machinery and hazards from natural events.

But manufacturing companies that rely on functioning technology should also take out extended coverage. Other industries that can benefit from such insurance include logistics and transportation companies, as well as companies in the renewable energy sector.

Your advantages with us

personal

customer service

individual

Risk analysis

Building demand-driven concepts

Advice on mechanical and electronic security measures for loss prevention

Regular review

of your contracts

excellent

partner network

Any questions?

How can we

help you?

You can reach us by phone, email or by filling out the form below.

By contact form, mail or phone